Table of Content

TABLE OF CONTENTS

Overview

Banking Regulations - Overview

Managing regulatory issues and risk has never been so complex. Regulatory expectations continue to rise with increased emphasis on the institution’s ability to respond to the next potential crisis. Financial Institutions continue to face challenges implementing a comprehensive enterprise-wide governance program that meets all current and future regulatory expectations. There has been a phenomenal rise in expectations related to data quality, risk analytics and regulatory reporting.

Following are some of the US regulations that MDM and customer 360 reports can be used for compliance:

FATCA (Foreign Account Tax Compliance Act)

FATCA was enacted to target non-compliance by U.S. taxpayers using foreign accounts. The objective of FATCA is the reporting of foreign financial assets. The ability to align all key stakeholders, including operations, technology, risk, legal, and tax, is critical to successfully comply with FATCA.

OFAC (Office of Foreign Asset Control)

The Office of Foreign Assets Control (OFAC) administers a series of laws that impose economic sanctions against hostile targets to further U.S. foreign policy and national security objectives. The bank regulatory agencies should cooperate in ensuring financial institutions comply with the Regulations.

FACTA (Fair and Accurate Credit Transactions Act)

Its primary purpose is to reduce the risk of identity theft by regulating how consumer account information (such as Social Security numbers) is handled.

HMDA (Home Mortgage Disclosure Act)

This Act requires financial institutions to provide mortgage data to the public. HMDA data is used to identify probable housing discrimination in various ways.

Dodd Frank Regulations

The primary goal of the Dodd-Frank Wall Street Reform and Consumer Protection Act was to increase financial stability. This law places major regulations in the financial industry.

Basel III

A wide sweeping international set of regulations that many US banks must adhere to is Basel III. Basel III is a comprehensive set of reform measures, developed by the Basel Committee on Banking Supervision, to strengthen the regulation, supervision and risk management of the banking sector.

What do banks need to meet regulatory requirements?

To meet the regulatory requirements described in the previous section, Banks need an integrated systems environment that addresses requirements such as Enterprise-wide data access, single source of truth for customer details, customer identification programs, data auditability & traceability, customer data synchronization across multiple heterogeneous operational systems, ongoing data governance, risk and compliance reports.

How MDM can help?

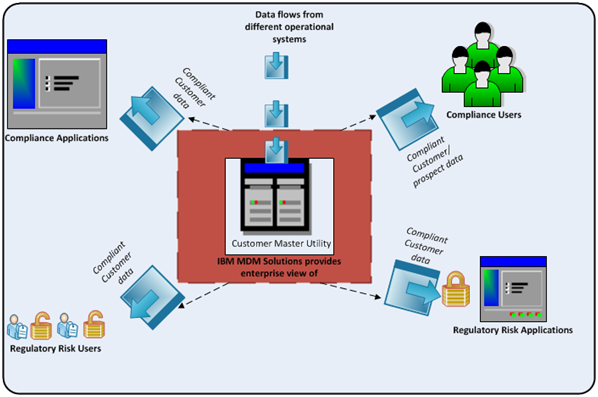

Enterprise view of customer data

MDM solutions providean enterprise view of all customer data to ensure that a customer is in compliance with Government imposed regulations (e.g. FATCA, Basel II/III, Dodd Frank, HMDA, OFAC, AML etc.) and facilitate data linking for easy access.

Compliance Users

Users who satisfy the compliance criteria will be able to retrieve the customer information such as name, address, contact method and demographics from the MDM solution. They will be able to ensure customer compliance while creating reports, performing reviews and monitor the customer against watch lists.

Compliance Applications

FATCA supporting applications, Dodd Frank reporting applications, HMDA compliance reporting applications, Basel II & III compliance applications receive a data extract from the MDM solution containing detailed customer information such as name, addresses, contact methods, identifiers, demographics and customer to account relationships that enhance compliance reporting and customer analytics.

Compliance users can ensure compliance with all FATCA laws, create reports, link customer information to create HMDA reports and provide complete financial profile of all commercial customers to ensure compliance with Basel II & III regulations

Regulatory Risk Users

Regulatory risk users will be able to use customer data from MDM solution, create reports on an ad hoc basis, and perform annual reviews to ensure customer is compliant with risk regulations. These users will also be able to check if customers are on existing watch lists through pre-configured alerts and update the MDM solution as required during annual reviews.

Regulatory Risk Applications

MDM solution supplies detailed customer information such as name, addresses, identifiers, demographics, and customer to account relationships to Applications supporting AML, OFAC data, KYC, fraud analysis so that they can determine compliance to regulations such as AML. OFAC standards, determine if the proper KYC data has been captured for all customers and monitors fraudulent activities of any customer.

MDM solution will receive a close account transaction from the AML applications if the regulatory risk user determines the customer relationship must be exited for AML non-compliance.OFAC applications update customer’s watch list status within the MDM solution and send add/update/delete customer alert transactions to monitor customers on OFAC watch lists.

Conclusion

MDM solutions when implemented properly, can provide critical information to banks who have to comply with a number of regulations across many countries. At InfoTrellis, we have helped many organizations achieve these goals through IBM MDM implementations.

About the Author

Greg Pierce

Greg is a Senior MDM Business Architect at InfoTrellis. He has helped many clients across banking, insurance and retail clients actualize value out of their MDM investments.

Kia sportage vs nissan qashqai egypt, Ford fiesta 2009 bluetooth problems, Tamiya volkswagen golf gti cup car

Tags

Data-as-an-Asset

Greg Pierce

Senior MDM Business Architect

Helped many clients across banking, insurance & retail clients actualize value out of their MDM investments

-2.jpg?width=240&height=83&name=Menu-Banner%20(5)-2.jpg)

.jpg?width=240&height=83&name=Menu-Banner%20(8).jpg)